Kraft Heinz Pushes Refresh Strategy Amid Mixed Market Sentiment

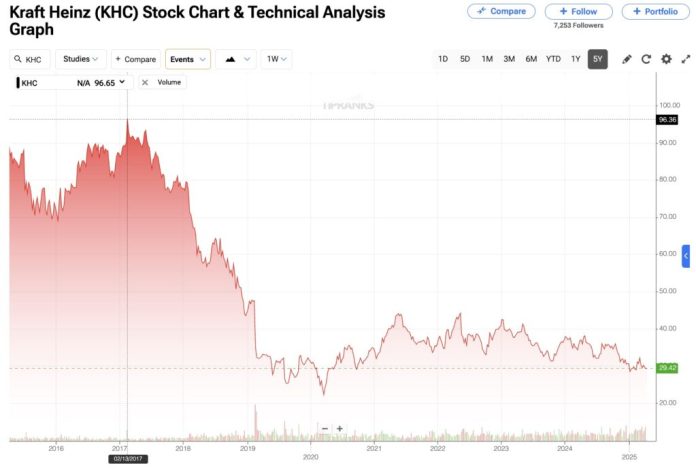

The Kraft Heinz Company (NASDAQ: KHC) is drawing renewed investor interest following positive commentary from Bank of America, which maintains a Buy rating and a $45 price target on the stock. Analyst Bryan Spillane described Kraft Heinz as a “show me” story that’s turning the corner on execution, highlighting a mix of compelling value and improving fundamentals.

The food and beverage giant has faced headwinds amid shifting consumer behaviors and heightened price sensitivity in key markets. However, analysts now point to signs of stabilization. Notably, Kraft Heinz’s comparable sales performance has shown improvement in the most recent quarter, driven by price/mix gains and growth in emerging markets.

Bank of America emphasized that while Kraft Heinz’s growth expectations remain muted – with the company guiding for organic net sales growth of just 1-2% and adjusted EPS growth of 1-3% for this fiscal year – the stock’s current valuation offers upside potential. KHC trades at a forward P/E multiple of roughly 11x, lower than the industry median, reflecting cautious optimism as recovery efforts take shape.

Commodity cost deflation and productivity-based margin expansion are among the levers being watched closely by equity analysts. Kraft Heinz’s ability to reinvest in marketing and innovation, particularly in its core condiment and meal solutions categories, is also seen as pivotal to rekindling consumer engagement and sustaining retailer support.

Challenges persist in Kraft Heinz’s refrigerated and frozen segments, where competitive pressures and private label gains have strained volumes. Still, analysts note that management’s disciplined cost control and focus on household penetration provide a solid foundation for long-term resilience.

Investors continue to look for evidence of sustained volume recovery across key brands, especially given the company’s exposure to both low-income and value-oriented households. With a dividend yield above 4%, Kraft Heinz attracts income-seeking investors, further supporting stock stability during portfolio rebalancing in the packaged food space.

For FMCG stakeholders, Kraft Heinz’s strategic recalibration highlights broader sector trends: a shift toward greater efficiency, sharper pricing strategies, and renewed emphasis on brand equity in a more price-conscious consumer environment.

Whether this signals a lasting comeback or a temporary lift remains to be seen. But with management focused on margin expansion and targeted growth, Kraft Heinz is positioning itself to navigate current