Kraft Heinz Eyes Margin Expansion as Cost Discipline, Resilience Support Growth

Kraft Heinz is signaling renewed investor confidence as the food and beverage giant leans into operational efficiency and stable demand across its core portfolio. Shares of the company (NASDAQ: KHC), which have lagged behind broader market indices for years, are beginning to show signs of momentum, driven by improving profitability and disciplined execution.

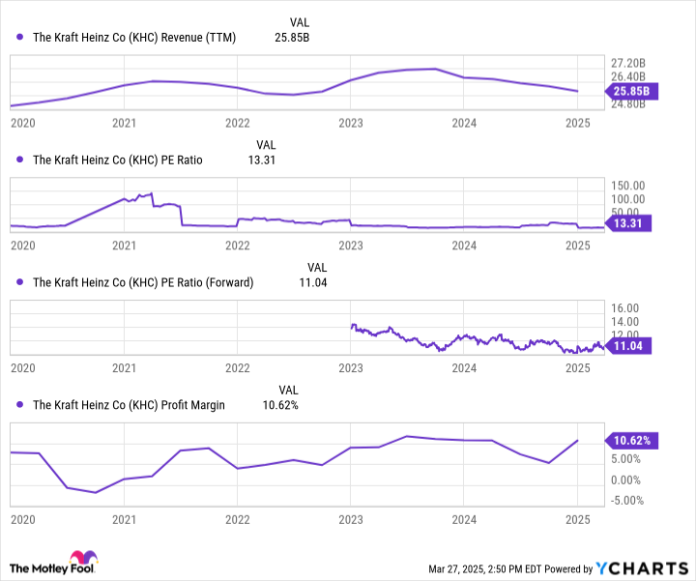

Although net sales dipped slightly by 1% in 2023 to $26.6 billion, the decline was largely expected following the post-pandemic normalization in at-home consumption and price stabilization after multiple rounds of inflation-fueled hikes. Importantly, Kraft Heinz delivered a solid 6% increase in operating income, driven by cost-cutting efforts and improved supply chain execution.

This efficiency push is translating into stronger margins. Gross margin expanded to 33.5% in Q4, up from 31.3% the previous year, even as demand for premium and convenience-focused food options remained strong. The company’s emphasis on pricing power and strategic brand investments—particularly in platforms like Lunchables and Kraft Mac & Cheese—is helping to offset volume softness in certain categories.

CEO Carlos Abrams-Rivera, who officially assumed the role in 2024, is focused on unlocking long-term value through innovation, channel diversification, and operational streamlining. The company’s adjusted EPS outlook for 2024 sits between $3.01 and $3.07, pointing to low single-digit growth even in a cautious consumption environment.

While Kraft Heinz currently trades at roughly 12.5 times forward earnings—well below the S&P 500 average—the company’s steady cash flow generation and a dividend yield near 5% are attracting attention from income-focused and value-driven investors.

For FMCG professionals, Kraft Heinz’s performance underscores a critical trend: legacy food manufacturers can create shareholder value by recalibrating brand portfolios, embracing disciplined cost management, and enhancing productivity—all while sustaining relevance in evolving consumer segments such as snacking, ready-to-eat meals, and better-for-you options.

As the packaged food sector continues to stabilize from pandemic-related volatility, players like Kraft Heinz that maintain pricing power and a sharp focus on margins are set to benefit from incremental growth and defend their shelf space amid fluctuating demand patterns.